How to Buy a Home With Student Loan Debt in 9 Essential Steps

The American dream is dead, at least the average millennial is told that’s the case. Many news networks state that more millennials are opting to not buy a home because…they just don’t want one. They’d rather travel the world than own a home. Yet, numerous studies show that’s actually far from the truth.

The National Association of REALTORS® (NAR) states that 80% of non-buyers say that student loans are what’s keeping them from buying a home. So, if deep down you know that you’re one of those people that believes vicious student loans are keeping you from purchasing a home, there’s hope.

You don’t have to let student loans stop you from acquiring wealth through real estate and purchasing a home you love.

The steps you take to acquire a home will be different from the steps Generation X and baby boomers had to take, but you can do it.

Here are 9 essential steps to take you through purchasing a home, even if you have student loan debt.

What could stop you from getting a home loan

Many lenders look at the time you’ve spent working in your industry as a prerequisite to getting a home loan. Usually, they want to see you’ve worked in your industry with a W-2 for at least 1 year. If you’ve started a business, then the timing can differ.

Your debt to income ratio is another high determining factor which can inhibit your ability to get a home loan. If you’re not entirely sure what debt to income means, it’s the amount of debt in proper proportion to your take-home pay. Lenders want to see debt to income no more than 43%. For example, if you make $1,000 per month and your monthly payment is $430, that’s about the most a lender would consider. Anything above that would be high and the bank may think that you’re a tad bit over leveraged and you’ll have trouble getting a loan.

To be on the safer side, refrain from having debt payments more than 30% of your average take-home pay.

Decide HOW you want to buy a home

Depending upon your method of purchasing a home, you can use manual underwriting to buy a home while being debt-free, or you can buy a home on credit. Either way, you’ll want to decide which route you’d like to take before considering buying a home.

It’s important to remember that either way, you’ll want to bring down any consumer debt. Consider consumer debt as any item that either goes down in value and can’t be sold for a profit. I.e. Very few cars you can sell for a profit. Clothes you may be able to resell them, but they’ve still gone down in value. If you purchased a dress for $100 and you can’t sell it for more than $50, that’s consumer debt.

Know your credit score

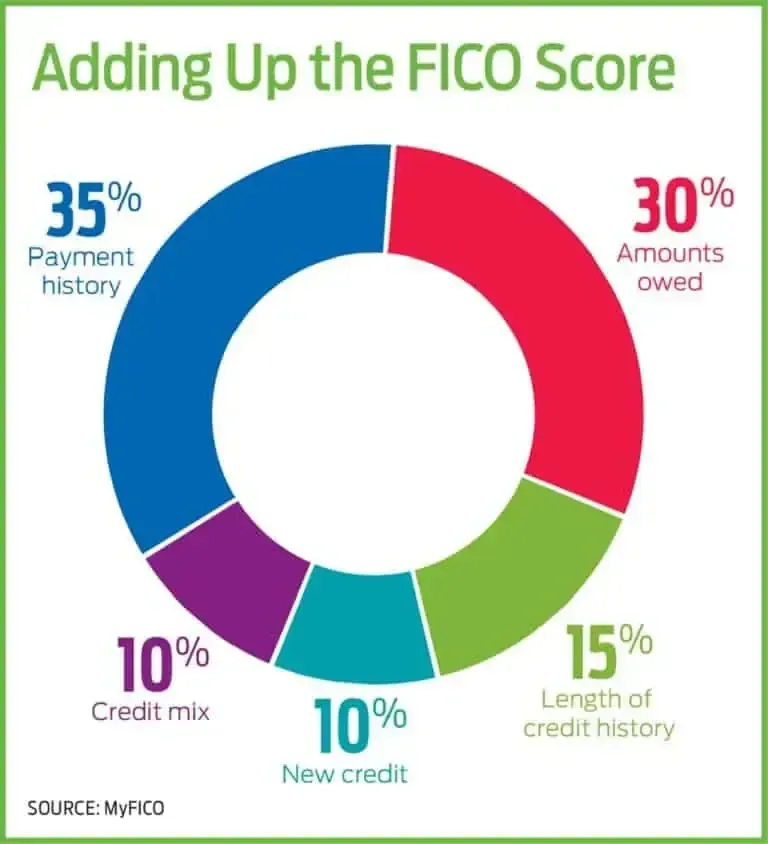

Your credit score is a major key factor lenders use to determine if you’re a high risk borrower. The lower your credit score, the more at risk a lender sees you as defaulting on the loan.

You may have a credit card you’re very responsible with, and check your credit only to find out that it’s still pretty low. That’s because your credit scores are impacted by more than one type of credit.

The following areas make up your credit score.

You can use freecreditreport.com to check your credit score from all 3 major reporting companies. There are also reporting agencies like Experian that will allow you to check your credit once per year for free. Throughout this process, you’ll want to be actively managing your credit. You can use an app called Mint to manage your budget and your debt all in one place.

Manage your student loans

Pay your student loans on time. Defaulting on your student loans can drastically affect your credit. On top of that, student loans are not bankruptable. While many may just want to wipe it away clean, you’ll need to manage your loans

Take a look at your monthly payments. Are they a little high? You may want to consolidate your loans if possible. This can help reduce your monthly payment so you can continue putting money towards your down payment on a house.

Reduce discretionary spending

You may want to sacrifice for a while in order to buy a home. That may mean taking your lunch to work instead of eating out with coworkers, pulling back on money spent on clothes, restaurants, shopping and more.

The time you can spend saving your money to purchase a home will be worth it in the end. By reducing your expenses you can save for a higher down payment. Putting a higher down payment on a home will reduce your monthly mortgage payment and if you put down 20% on the cost of a home, you’ll also avoid paying Private Mortgage Insurance (PMI).

Reduce your housing costs

No more than 30% of your income should go towards your housing costs. So that you’re not a renter forever, you’ll want to reduce your largest expense which for most is their housing. There’s a couple of ways you can do this:

- Stay at home for a while where rent is free – In Placer County, the average cost of rent for a 1 bedroom is $1,400. When you add on utilities, the Internet, gas, electric, and rental insurance you’re looking at closer to $1,600 per month in rent. You could be saving the $1,600 per month and at the end of the year place $19,200 towards a down payment on your home. You may not want to spend an extra year living at home, but when you think about having your own home, doesn’t that short sacrifice seem worth the long-term gain? Most would say so.

- House hack for a while and get a roommate – If you rented a home by yourself, you can choose your tenants, determine how much your roommates will pay and live for free. Just make sure your landlord approves of the renter beforehand.

- You can also turn your space into a short-term rental – You may be able to Air BnB your rental on the weekends to help reduce the cost of the rent. (Make sure to double-check your lease and see if this is allowed. If you’re not sure, talk to your landlord.)

Consider housing down payment assistance programs

When you’re ready to purchase a home, there are a couple of financial programs available to help you pay for a down payment and more.

The Federal Housing Administration (FHA) loan programs are geared towards first time home buyers with less than perfect credit scores. At the time this article was written, the average down-payment was only 2% of the housing price. Plus, your credit score only needs to be about 650 or less.

If you’re a veteran of the military, you may qualify for a VA loan. Currently in 2019, a VA loan doesn’t require a down payment of any sort, making it a loan product to consider if you simply don’t have the reserves in place to give a large down payment.

Increase your income

You can get a second job to help save up for a down payment or to help increase your income. One way that many individuals are increasing their income is through freelance work. Sites like Upwork, Fiverr, and 99Designs, support graphic designers, virtual assistants, marketers, data assistants, and more who are looking to sharpen their skills and make extra money freelancing. If you are taking on a second job, try to find work in your current career field. Increasing your income in your chosen career field can help increase your credibility with a lender.

If you’re not interested in freelancing, or you’re unable to find a second job in your chosen career field, consider looking for a job with a company that offers assistance in student loan payments or student loan repayment programs for graduates.

Actively monitor your lines of credit

If you’re over leveraged, find ways to reduce the number of payments you have. For example, you might consider reducing your car if you have car payments

You may have heard this many times before, but make sure to pay off your credit cards every month. This looks great on your credit, and shows you’re a responsible borrower.

Consider buying a home with a co-borrower

If you’ve been saving for a home to buy, and it still feels like a financial stretch, opt for a co-borrower. Many individuals will purchase a home together in order to start building wealth. You’ll have much more control over the house and can use your home to build other streams of income like deciding to:

- Rent out the spare bedrooms (In Placer County and Sacramento County, the average cost is $900 per room. If you purchase a 3 bedroom/2 bath home at $350,000 your total mortgage payment could be $2,200. Renting out two of the three bedrooms for $900 each would bring in $1,800 per month plus utilities, reducing your rent to $400 per month.)

- Air BnB – You can AirBnb your home on the weekends and bring in an extra $75-$100 (depending on your area) or more per night. Doing this strategy four weekends per month could save you an extra $400 per month in rent.

- Make it a vacation rental – If you’re someone who enjoys traveling, you may want to turn your home into a vacation rental during the summer months.

If you decide to get a co-borrower, make sure you’re protected if you go this route. You may want to have a thorough agreement in writing and discuss how long you plan to live in the house and different exit strategies should things not proceed the way you’d like it to. Make sure you and the co-borrower are on the same page from the very beginning regarding what you’d like to do with the house and when you’d like to sell.

Conclusion

Having student loan debt doesn’t mean you’ll have to forego your dream of buying a home. Buying a home even if you have debt, might be closer in your future than you think. By following these steps, you’ll be able to move in the right direction towards finding a home that suits you, your budget and put you on the path towards building wealth.

Contact us and learn more about our simple step-by-step process of buying a home.